Such globe-best home loan pros will require committed to ask the proper inquiries in order to examine a huge selection of loan options and acquire the best option financing to suit your private demands. Talking about charge and you may expenses you only pay whenever finalizing the financial and you will house purchase, usually ranging from 2-5% of your loan amount. Speaking of one to-time costs paid back when selecting your residence, as well as your downpayment, settlement costs, and you will swinging costs.

- Bank research rates usually produce some other results.Their Aussie Representative also provide a more accurate credit power imagine according to your bank of choice.

- Enjoy a competitive changeable rate and financing have to provide the flexibleness you want.

- You should consider whether it is befitting your ahead of getting the merchandise otherwise solution.

- It’s basically a track record of your ability to satisfy debts, lease and other financial obligations promptly.

- To purchase a home includes way too many will cost you which can consume to your deposit.

Stamp Responsibility Calculator

Because of this a much bigger deposit do trigger a lesser LVR, causing you to more popular with loan providers and you can qualifying your for best rates and you can big financing numbers. Borrowing from the bank strength are computed considering plenty of details one affect debt issues. Surprisingly, that have a premier and steady money stream may well not necessarily effect within the a higher credit ability, while the lenders put better emphasis on their debts and you can record. Here are some examples of how much you would need to use with different possessions thinking, as well as payments, based on a 20% deposit size and you will an excellent 6.00% rate of interest. Determine cost to possess antique, FHA, Virtual assistant, and you will USDA financing that have precise insurance coverage calculations and you will advance payment conditions for each type of.

Your data

A much bigger deposit grows the to find power through the elimination of your own loan amount and you will possibly getting rid of financial insurance premiums. But not, moreover it cuts back your readily available dollars to other costs and you may problems. Down payment costs are only the start — you’ll also have to take into account settlement costs and ongoing resident expenses, such as possessions fees and you will insurance, and you also’ll should budget for repair will cost you.

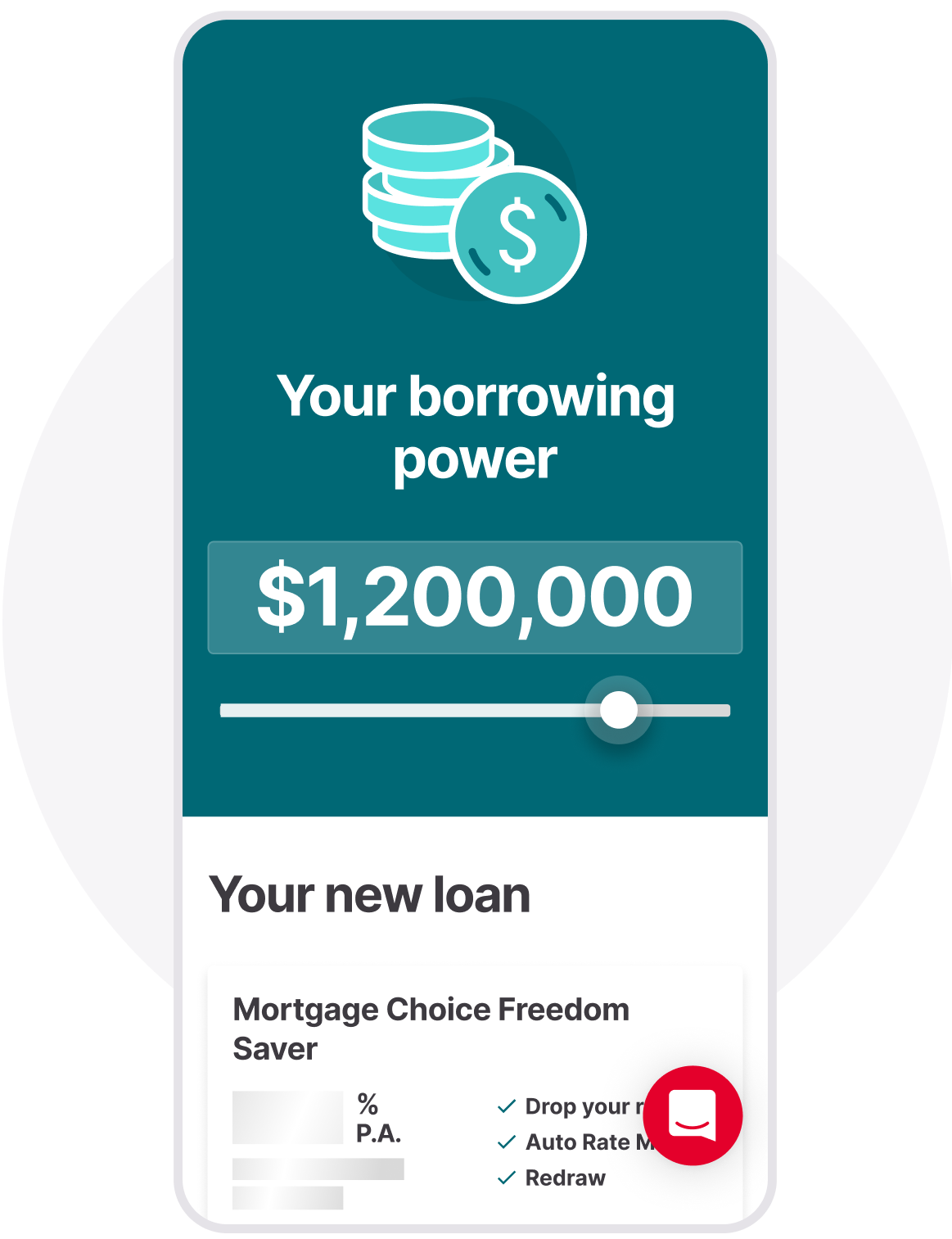

We are able to compare thousands of home loans of more than twenty five best loan providers. House guarantee ‘s the difference between a great property’s economy well worth and you can people debt kept against they. Borrowing strength, called borrowing from the bank capacity, is the amount borrowed you to definitely a lender tends to approve a debtor to have.

Initial Will cost you

Should you, the financial institution have a tendency to assess you considering a joint money software and your borrowing electricity could be a lot more highest thus.

Loan to well worth proportion (LVR) is a very common metric employed by loan providers inside pre-certification to possess a home loan. It will be the home loan shown as the a proportion of your full property value.

Their rate of interest usually determine all round measurements of their lingering home loan repayments, therefore it is an essential varying when figuring your residence loan borrowing energy. Even though you pay back your own mastercard harmony completely each month, lenders however use your complete credit card restrict whenever calculating your own complete liabilities and just how they apply at your credit electricity. When we’re also assisting you to apply for a mortgage, we are able to design your position centered on a lower if any credit limit, that will improve your potential borrowing from the bank energy.

- So it additional shelter lowers the financial institution’s exposure, that could will let you obtain many help your avoid lenders home loan insurance (LMI) when you yourself have below the usual deposit.

- Mortgage brokers have a tendency to work on the DTI as the an important metric to possess figuring the amount of money you might obtain.

- Whenever figuring your liabilities (or no), you will find assumed you to definitely one existing financing involves both principal and you can interest costs to your longevity of the borrowed funds.

- It’s another way to rating at ease with your house to shop for power you can also have, otherwise have to obtain.

- Determine what you are able get to the an enthusiastic $85k paycheck — that have otherwise instead of a downpayment.

- If you are an initial household client already renting, you can attempt how much you really can afford in order to borrow having fun with your lease because the a harsh union.

Lenders following go through the advised financial loans since the a percentage of the monthly money and construct in the a boundary to have possible interest goes up. Sure, you can still qualify for a mortgage that have student loan financial obligation. Lenders should include their education loan payments on your own personal debt-to-income proportion.

In certain states, such as Victoria and you will The newest Southern Wales, eligible basic-home buyers can be exempt of stamp responsibility or found significant concessions on the services less than a specific worth. Find out how earliest home buyers can save for the stamp obligations with exemptions otherwise decreases, making the dream of home ownership cheaper and simpler to reach. Possessions taxation prices are different somewhat because of the state, state, and even town. Says including Nj-new jersey, Illinois, and you will The newest Hampshire are apt to have highest assets taxation costs (more 2%), when you are says for example Their state, Alabama, and you can Texas have down cost (less than 0.5%). Rating a quick imagine about how far you could potentially conveniently manage so you can use from Past Bank. Work-out the fresh stamp obligation for every state and you can region inside the Australia, as well as examine duty to the property and you may property.

They could and take into consideration the stability of your employment to find out if you could potentially still fulfill dominating and you may desire payments in the long run. Liquid assets for example savings and you may nonexempt assets, we.age. stocks, securities or common financing might possibly be held within the high value from the financing institutions. AssetsWhen lenders evaluate your residence application for the loan, the full property value assets you own was key to deciding your ability in order to meet mortgage costs.